Withholding Tax on Real Estate Sales by Non-residents of Japan

The Japanese tax system is applicable to individuals living in Japan, irrespective of their nationality (referred to as residents). On the other hand, individuals not residing in Japan (referred to as non-residents) are only liable for taxes on income generated within Japan. For example, if a non-resident sells Japanese real estate while residing abroad or earns income from renting real estate owned in Japan, they fall into this category.

Furthermore, to prevent the underreporting of income by non-residents in such real estate transactions, Japan employs a "withholding tax system", which mandates that a certain percentage of the sales proceeds or rent is collected from the payer and pre-paid to the tax office.

※Definition of "non-resident": A person who does not have a residential address in Japan and does not have a continuous stay in Japan for more than one year. (e.g., foreigners living abroad and Japanese citizens living abroad)

In what case will the withholding tax be imposed upon the real estate sale?

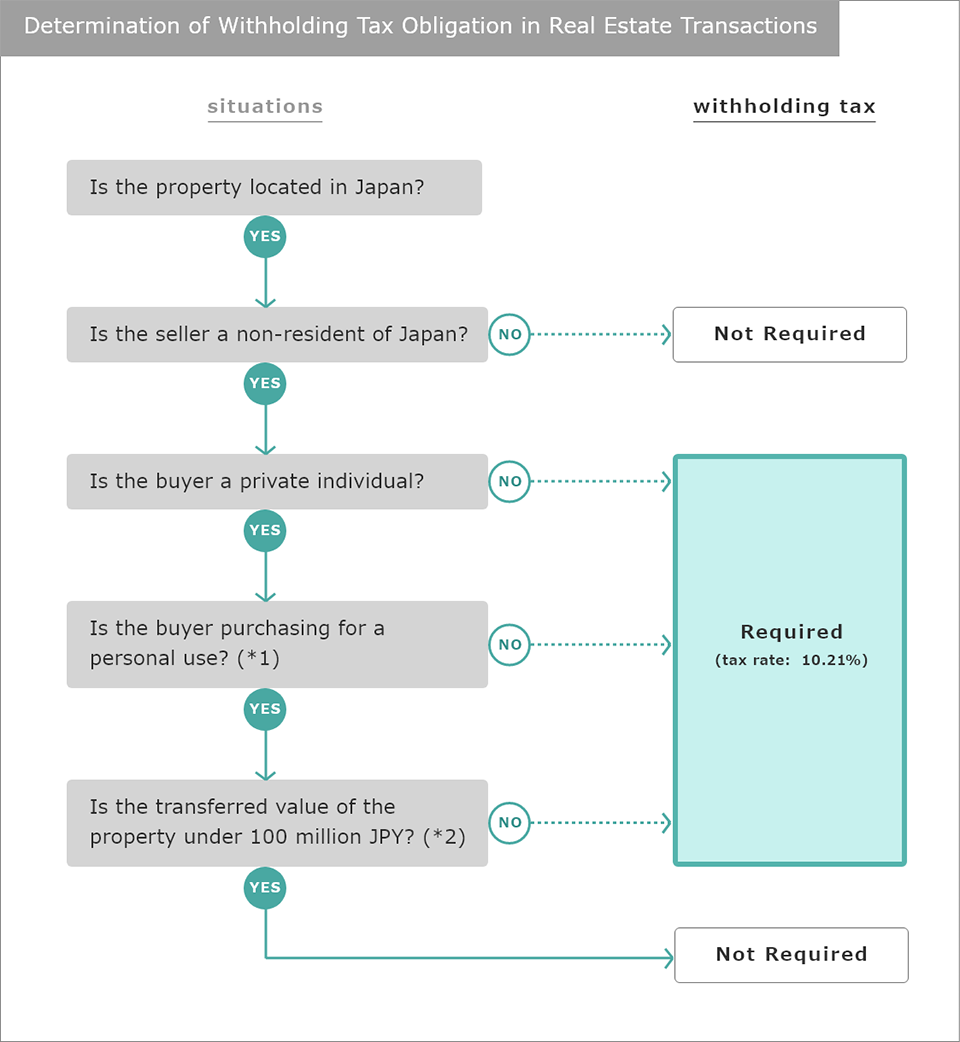

If the seller of a Japanese real estate is a non-resident, depending on the situation, the buyer of the property is required to withhold 10.21% of the payment amount as withholding tax. In other words, the amount paid to the non-resident is equivalent to 89.79% of the payment amount (the remaining amount after withholding tax). This withholding tax must be remitted to the tax office by the 10th day of the month following the transaction.

The diagram below illustrates whether withholding tax is required for a real estate transaction:

- ※1 Personal use as a residence of the buyer or relatives (spouses, blood relatives within the 6th degree, and in-laws within the 3rd degree).

- ※2 The determination of whether the selling price exceeds 100 million JPY is made based on the share of each co-owner. (Please be aware that even if the transaction amount is less than 100 million JPY, including settlement amounts like fixed property tax may exceed 100 million JPY.